Automobile Insurance Lawyers Indianapolis, IN

Five elements that account for your Indiana automobile insurance rates and premiums

Each individual insurer sets Indiana automobile insurance rates. Before the prevalence of online databases, an automobile insurance company could set the price of a policy using a handful of variables: 1) the sex and age of household drivers, 2) residential zip code, 3) use of the vehicle (pleasure or transportation to work), 4) driving records of eligible household members including past claims history, 5) make/model of vehicle. The sum of these categories was usually enough information to evaluate a client’s risk and price their automobile policy accordingly.

Technological progress factors in setting Indiana automobile insurance rates

Subsequently, due to the widespread use of online electronic databases, insurance companies sought an improved model using a statistical methodology for evaluating the assumption of risk. In addition to the above factors, the new formula called the Credit-Based Insurance Score would delve into an applicant’s personal financial records and credit worthiness.

This scoring system was introduced in the latter decades of the twentieth century. And in years since, other number-crunching firms have joined the ranks of insurance score predictors.

Credit-based Insurance Scores

Credit-based insurance scores differ from credit scores by categorical weight. Insurance companies use credit-based insurance scores to predict the likelihood of individuals filing claims in states and provinces where it is legally allowed as an underwriting risk and rate factor. Four states, California, Massachusetts, Hawaii, and Michigan bar the use of credit scores to influence automobile insurance rates while others limit their use.

The credit-based insurance score cannot, however, be the sole determining factor in states where the scoring tool is legal. Underwriters may set customer rates, cancel high-risk accounts, and fail to renew existing clients’ policies. But state regulators disallow the use of the credit-based insurance score as the sole basis for their actions.

Facts & Fiction of Credit-Based Insurance Scoring

A few regulators have put forth that the credit-based insurance scoring system tilts against disadvantaged individuals and communities. In fact, statistics show that drivers with poor credit may experience rates 75% higher than their counterparts with excellent credit ratings.

But on the other hand, insurers may not exclude persons with little to no credit history as credit-based insurance scoring is only one factor among many that are considered when presenting the cost of a policy.

Another concern consumers have is that when shopping for insurance, the insurer’s credit-based insurance call will put a hard hit on your score. This is untrue; it will not negatively affect your credit score.

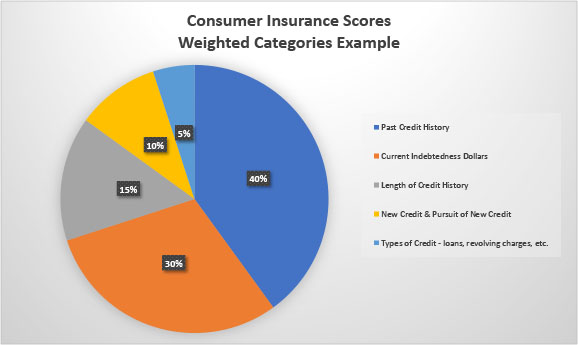

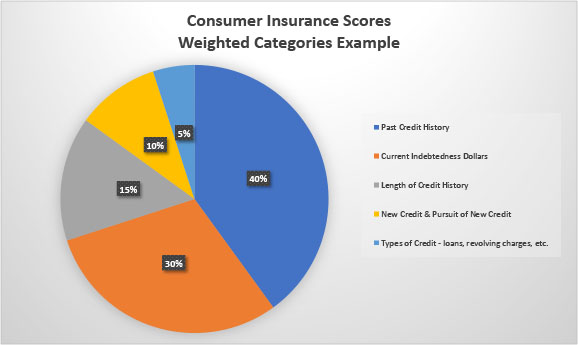

FICO’s Weighted Categories

The Fair Isaac Corporation, commonly known as FICO, evaluates, reports, and sells consumer credit-based insurance scores to insurers. On its website, FICO breaks down its categories and the percentage of weight applied to each. To learn more about FICO’s credit-based insurance scores, visit their website.

The infographic below represents how much weight may be given to the categories of a consumer’s insurance score.

Credit-based insurance categories and referenced examples

Past credit performance

Payment history includes the number of late payments, collections, and bankruptcy.

The current level of indebtedness

Includes the number of balances and the total amount owed on credit, revolving credit cards, and the proportion of payments left on installment accounts.

Length of credit history

Agencies like to see a long credit history of responsibly making payments on time. But if you have little to no credit history, there are other factors under consideration.

New credit and the pursuit of new credit

The pursuit of additional credit cards and the number of new accounts may negatively impact your credit score by reporting agencies.

Types of credit used

Creditors like to see that an individual can responsibly handle different kinds of credit, i.e., revolving charges as well as loans which may include installment loans such as mortgages, car, and student loans.

Check your insurance report for errors

If you feel the credit reporting agency has made an error in assessing your insurance credit score and is a factor in the cancellation of your automobile policy, non-renewal, or higher rates, ask your agent for the name of the credit reporting agency and inspect your report for errors.

Could the results of the observational study entitled – COVID vaccine hesitancy and risk of a traffic crash – drive-up your Indiana automobile Insurance rates?

A study recently published theorizes that “…individual adults who tend to resist public health recommendations, might also neglect basic road safety guidelines.” The results of this observational study seeking a correlation between COVID vaccine hesitancy, and the risk of a serious traffic crash appear in a 2022 issue of The American Journal of Medicine. Read the complete study here.

Using electronic medical records and partnering with 178 regional Canadian hospitals, traffic accidents involving emergency care were reported using vaccine status as the variable for a period of one month.

The results

The study showed that unvaccinated individuals (16% of the population sample) accounted for 25% of all identified crashes.

Putting the data to use

Although the study was performed in Canada, how likely are American automobile insurers to adopt the theory that the risk of claims increases for individuals that choose not to get the COVID vaccination? Or, put another way, will insured individuals receive a discount from their automobile policy provider for vaccination compliance? This is certainly something to watch. Why?

We are already using status to categorize

We know that under the Affordable Health Care Act, health insurance companies may legally charge smokers as much as 50% more than non-smokers. While under the Wellness Incentives provision of the Act, insurers may discount the premiums of individuals that participate in vaccination protection.

Smokers, on the other hand, are likely to pay premiums as much as three times more for life insurance than non-smokers. And the same is also true for obese policyholders.

The end game for drivers

In recent news, doctors now have a code for unvaccinated patients. But will automobile insurers gain access to customer health records, using that information to categorize the risk of clients? We can only wait and watch. Will risk providers have the will and find a legal path forward to factor in vaccine status?

Call Ward & Ward with questions about your insurance policy

Before you purchase your automobile insurance policy, you can learn more about coverage in Indiana by downloading our free e-book Why Do I Need a Personal Injury Lawyer For My Accident Claim. The last section will address Indiana automobile insurance rates and coverages you should know about.

If you have questions about your policy, our personal injury lawyers would be happy to address your questions.

Call Ward & Ward Personal Injury Lawyers today at (317) 639-9501 and ask for “Charlie.”